STOCK TRADING EXECUTION GUIDE

Stop staring at a setup you know isn’t there.

You don't have a strategy problem; you have an execution problem.This isn't about magic indicators it's the field manual for the trader who knows better but can’t seem to stop blowing it when it counts.

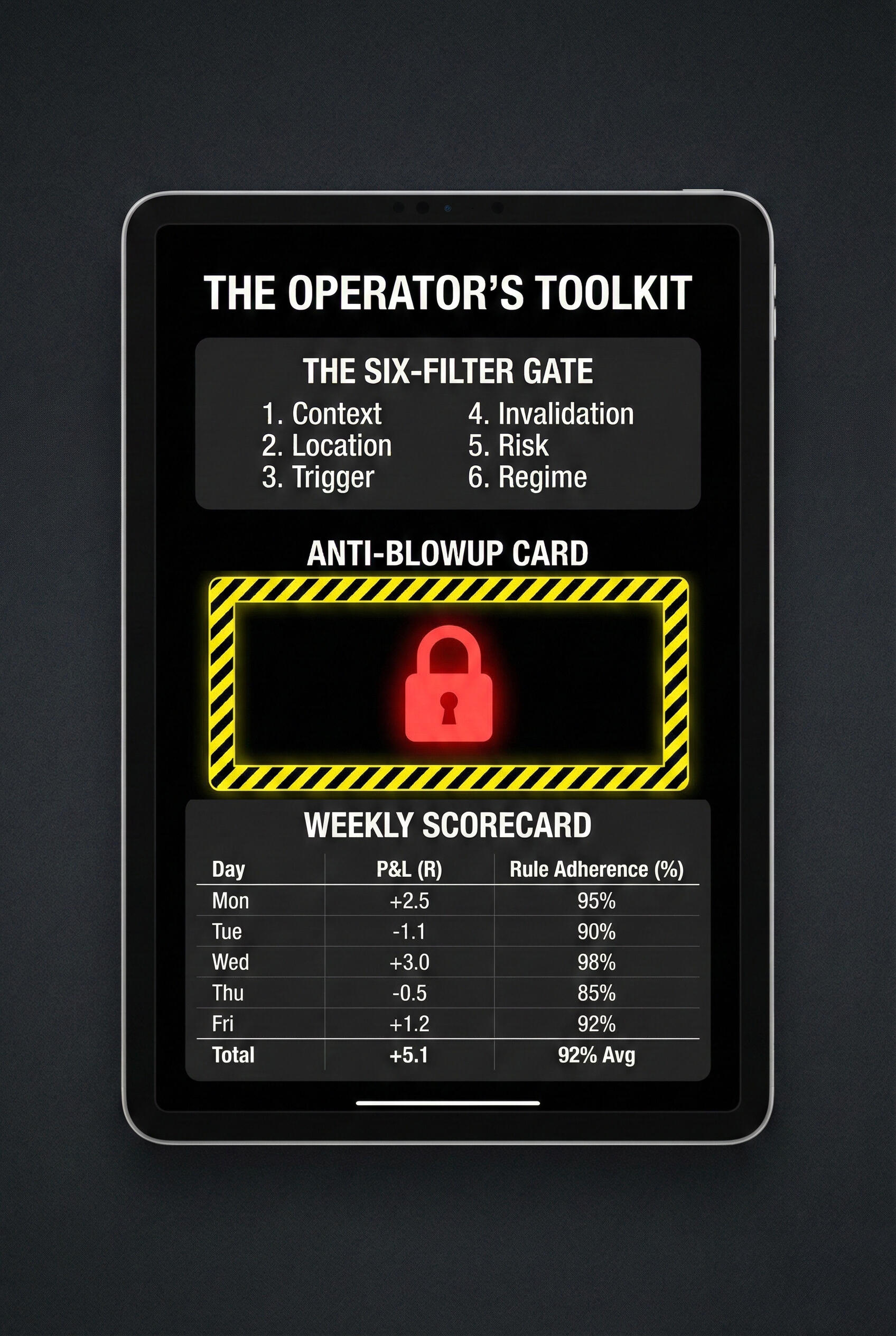

THE OPERATOR'S TOOLKIT

Turn Adrenaline Into Structure

Willpower fails. Systems don't. Stop relying on how you feel and start relying on these three non-negotiable protocols.

The FRVP Map

Stop guessing in the "mid-value" chop. Learn to map the market and only execute at the edge where the real decisions are made.

The Six-Filter Gate

A pre-trade checklist that kills FOMO instantly. If any of the six boxes are red, the trade is a hard pass. No negotiations.

The Anti-Blowup Bible

Install mechanical circuit breakers like the "First-Loss Lockout" to stop a spiral before it destroys your month.

THE OPERATING SYSTEM

Your New Daily Routine

This isn't a book you read once and shelve. It is a desk reference guide you will use every single morning before the bell rings.

The "If/Then" Logic Cards

Printable decision trees that make execution automatic. "If price does X, then I do Y." No guessing. No freezing.

The Weekly Scorecard

Stop obsessing over P&L. Start tracking "Net R" and "Rule Adherence." If you can measure your execution, you can fix it.

The One-Page Playbook

A single sheet that defines your edge. Context, Trigger, Stop, and Target. If the trade isn't on the page, you don't take it.

This is NOT for the

"Get Rich Quick" Crowd

If you are looking for a signal service or a magic indicator that predicts the future, close this page. This guide is for the trader who:✅ Has a strategy but lacks the discipline to follow it.✅ Is tired of giving back a week's worth of profits in one "tilted" morning.✅ Wants to treat trading like a business, not a casino.

What this guide solves:

If you struggle with any of the following, this book was written for you

❌ Giving Back Big Green Days

❌ Flipping Bias at the Open

❌ Trading "Almost" Setups

❌ Breaking Max Loss Rules

❌ Death by Breakeven

❌ Adding to Losers

❌ Trading Mid-Value Instead of Edges

❌ Tilt and Revenge Trading

❌ Inconsistent Position Sizing

❌ No Daily Routine

❌ No Real System at All

Inside the guide you will learn:

1. FRVP as a Map

Stop guessing. Use Fixed Range Volume Profile to define exactly where decisions happen and ignore the noise in the middle.2. The Execution Ladder

The professional sequence for every trade.3. The Six Filter Gate

A simple selection filter that eliminates impatience, FOMO, and impulse trades. If any filter is red, you pass.4. The Four Mechanical Plays

The only plays you need.5. Anti-Blowup Systems

The rules that saved thousands in losses.

6. PCR and RAR Tracking

Process Completion Rate, Rule Adherence Rate, and Edge Ratio so you can measure performance without emotion.7. The Weekly and Monthly OS

A complete operator's routine including daily checklists, weekly scoreboards, payout cadences, and risk of ruin checks. This is the part traders skip that turns you into a professional.8. The Reset and Recovery Protocol

Color Codes. Two sentence loop. Drawdown protocol.9. Playbook That Trades Itself

A one page setup template, scenario flow, disqualifiers, and weekly maintenance so your system improves itself over time.10. The Quiet Professional

Language, environment, behavior, and identity.

THE MATH IS SIMPLE

Cheaper Than Your Next Stop-Loss

Most traders pay the market thousands of dollars in "tuition" to learn these lessons. You can learn them today for less than the cost of a round of commissions.

ONE-TIME INVESTMENT

$49

Think about the cost of an evaluation reset. $100? $150? Or the cost of blowing a funded account? If this guide helps you prevent just one reset or saves one funded account, it has paid for itself 10x over.

You Have Two Choices Tomorrow Morning

Option A: You wake up, chase a "near" entry, get tilted, and dig a deeper hole. Option B: You wake up, open your One-Page Playbook, execute at the edge, and close green. Which operator do you want to be?

Frequently Asked Questions

Q: "I trade ES/Forex/Crypto, not NQ. Will this work?"A: Yes. While many examples focus on NQ, the principles of Execution, Risk Management, and Tilt Control are universal. The "Six-Filter Gate" works on any asset class.Q: "Is this a strategy guide?"A: There is a strategy section teaching FRVP but the focus is on Execution. It assumes you have a basic idea of how to trade (like FRVP) but teaches you how to actually press the button and build the system to manage the trade without losing your mind.Q: "What format is the book?"A: It is a high-resolution digital PDF optimized for tablets and desktop screens, so you can keep it open while you trade.Q: "What is the refund policy?"A: "Due to the digital nature of this product, all sales are final. Once the guide is delivered, it cannot be returned. We have packed this guide with specific, actionable protocols to ensure it provides value far exceeding the price, but please ensure the product aligns with your needs before purchasing."

© 2025 Worthy of Riches. All rights reserved.

Risk Disclosure: This material is for educational purposes only. Worthy of Riches is not a financial advisor. Trading involves substantial risk of loss and is not suitable for every investor. Past performance is not indicative of future results. Don't trade with money you can't afford to lose.